|

BANK A Invest with us! We pay 4.21% compounded daily |

BANK B Invest with us! We pay 4.213% compounded weekly |

BANK C Invest with us! We pay 4.219% compounded monthly |

BANK D Invest with us! We pay 4.225% compounded quarterly |

|

BANK A Invest with us! We pay 4.21% compounded daily 4.29962% APR |

BANK B Invest with us! We pay 4.213% compounded weekly 4.301227% APR |

BANK C Invest with us! We pay 4.219% compounded monthly 4.301547% APR |

BANK D Invest with us! We pay 4.225% compounded quarterly 4.29241% APR |

Figure 01

|

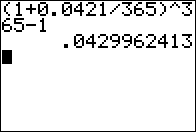

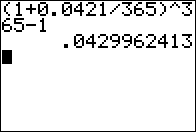

Computation for Bank A. |

Figure 02

|

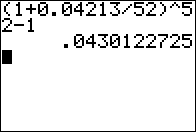

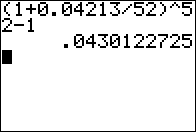

Computation for Bank B. |

Figure 03

|

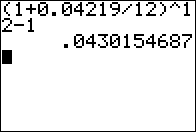

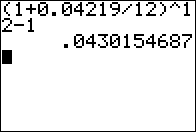

Computation for Bank C. |

Figure 04

|

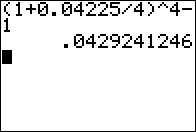

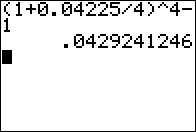

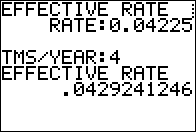

Computation for Bank D. |

Figure 05

|

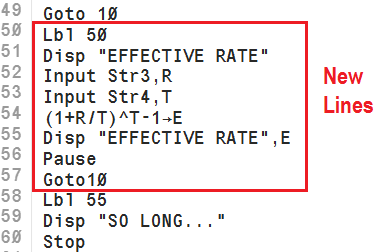

Using the mdified program for the values for Bank A. |

Figure 06

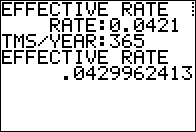

|

Using the mdified program for the values for Bank B. |

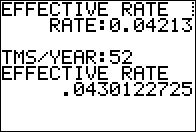

Figure 07

|

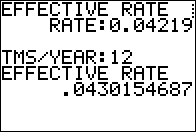

Using the mdified program for the values for Bank C. |

Figure 08

|

Using the mdified program for the values for Bank D. |